The U.S. Department of Justice (DOJ) has launched a major antitrust lawsuit against Visa, accusing the company of holding a monopoly in the debit card market. The DOJ claims that Visa has been using its dominant position to unfairly limit competition, leading to higher fees for businesses and consumers.

Visa’s Market Dominance and Fees

Visa processes over 60% of all debit card transactions in the U.S., allowing the company to collect billions of dollars in fees each year. Although these fees are paid by merchants, they are often passed on to consumers in the form of higher prices for goods and services.

Attorney General Merrick Garland emphasized the wide-reaching impact of Visa’s practices, stating that they drive up the cost of “nearly everything.” By keeping competitors out of the market, Visa ensures that consumers and businesses are left paying inflated fees, according to the DOJ’s complaint.

Visa’s Response to the Lawsuit

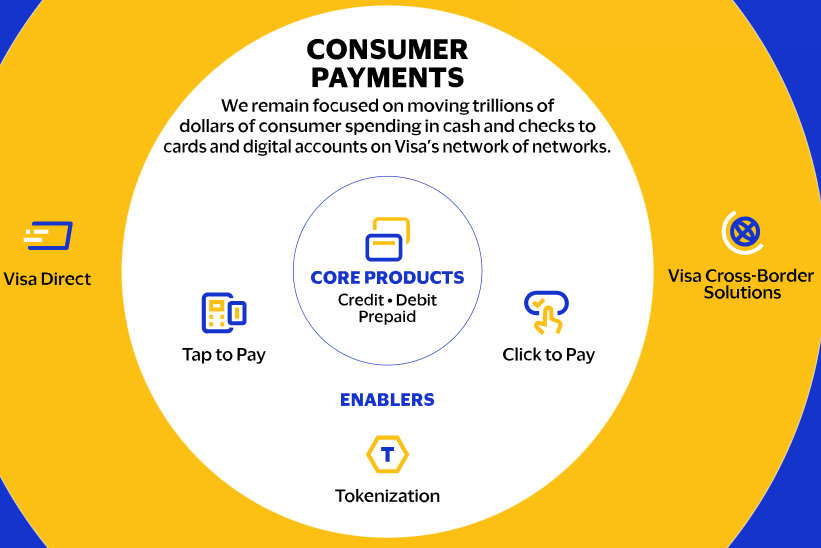

Visa has responded by calling the lawsuit “meritless.” The company insists that it faces plenty of competition in the growing world of digital payments. Julie Rottenberg, Visa’s General Counsel, emphasized that Visa offers a reliable, secure payment network trusted by both businesses and consumers.

DOJ’s Allegations of Exclusionary Practices

The DOJ alleges that Visa has made deals with major tech companies like Apple and PayPal to ensure they don’t become direct competitors in the debit market. These arrangements, according to the lawsuit, keep innovation down and help Visa maintain its grip on the debit card ecosystem.

A History of Antitrust Scrutiny

This lawsuit isn’t Visa’s first run-in with the DOJ. In 2020, the department blocked Visa’s attempt to buy fintech company Plaid, citing similar antitrust concerns. The current case is part of the Biden administration’s broader effort to address monopolistic practices across various industries.

Potential Impact on Consumers

If successful, the lawsuit could lead to increased competition in the debit card market, potentially lowering the fees merchants and consumers face. However, experts caution that any noticeable impact on consumer prices might take time and could be relatively small at first.

The outcome of this lawsuit could mark a significant shift in the debit payments market. While it may not bring immediate price cuts at the checkout counter, it reflects the ongoing battle between regulators and big corporations to foster fairer competition in the U.S. economy.